According to Espen Sørbø, Director for Hydrocarbon & Emission Solutions at Norwegian Energy Partners (NORWEP), FPSOs are becoming increasingly attractive solutions for new offshore greenfield developments, based on their ability to unlock remote deepwater reserves.

“2026 starts a sharp increase in FPSO project activity. Over the last two years we have seen only 11 FPSOs awarded. Now we expect 10 FPSO projects to be awarded every year for 2026, 2027 and 2028,” said Sørbø.

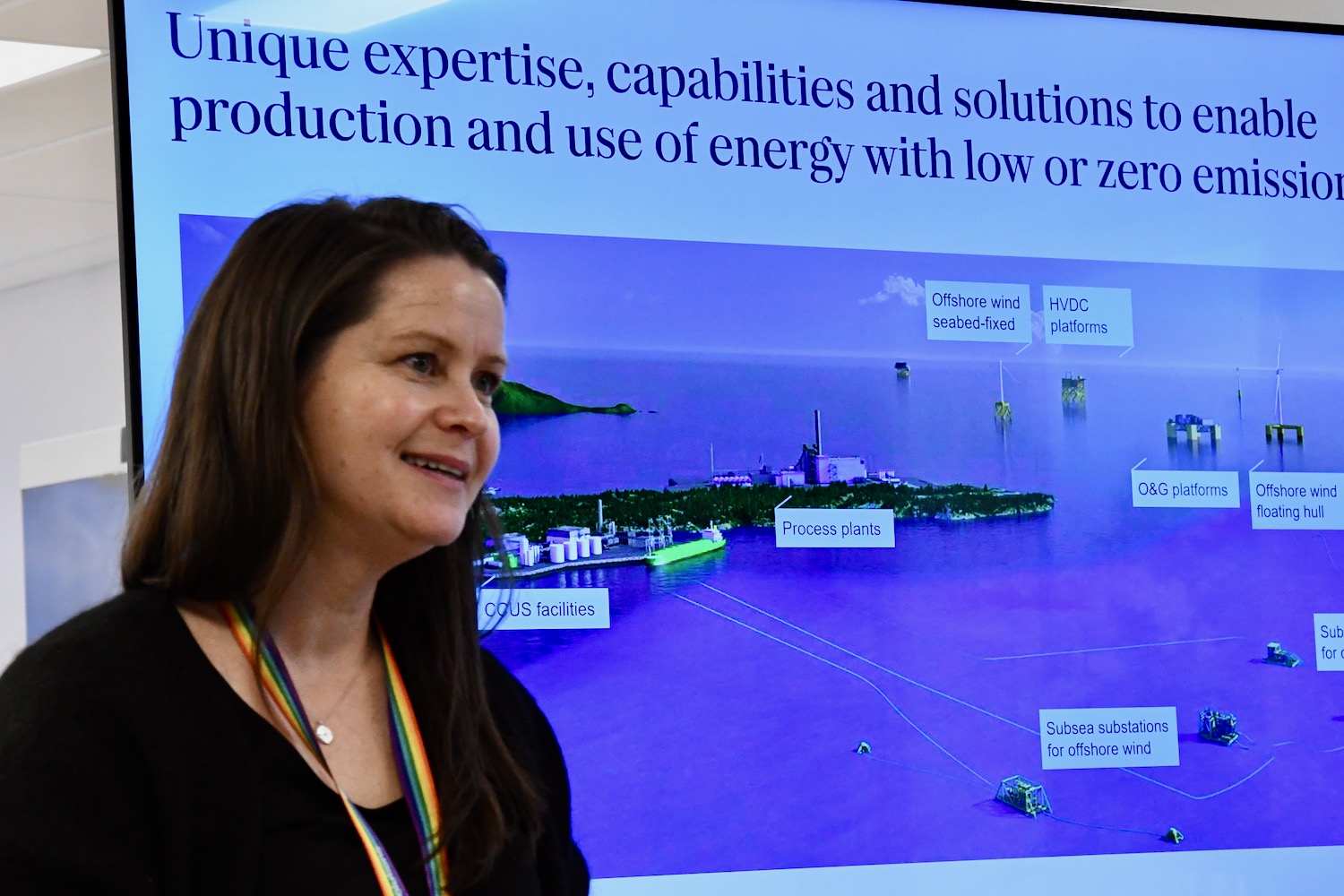

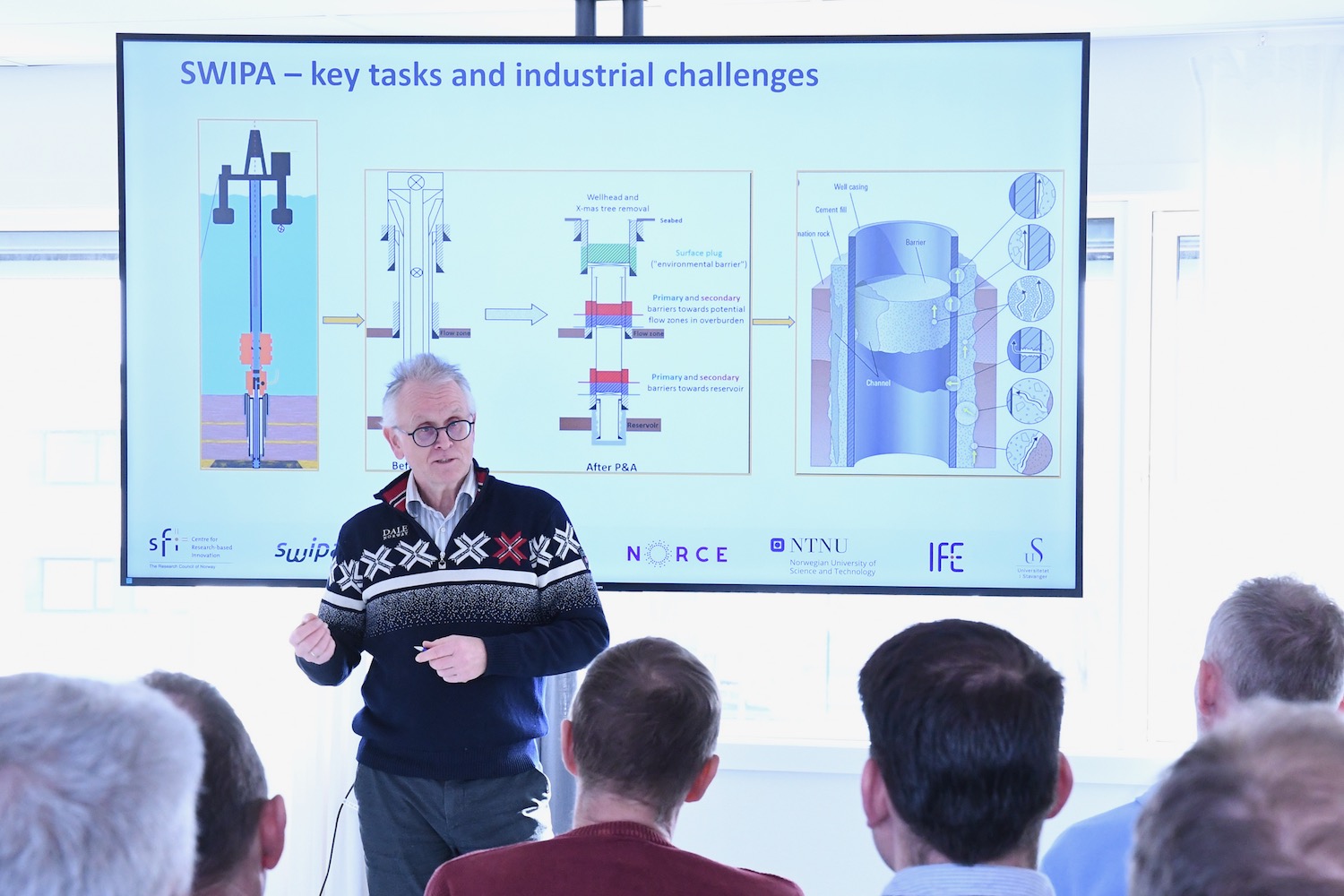

He spoke at the FPSO Forum, organized by GCE NODE and hosted by Firenor, in Kristiansand Thursday. More than 30 people from 21 companies participated in the event which included presentations by Firenor, BW Offshore, Aker Solutions, and Tratec Norcon.

STRONG GROWTH FORECAST

According to NORWEP, South America remains the dominant FPSO hub, driven largely by Brazil’s deepwater developments. Asia is experiencing high activity, and Africa is steadily increasing its FPSO fleet.

Two industry giants, Petrobras and ExxonMobil, are expected to account for 42 per cent of global FPSO investments between now and 2030. The total FPSO market value for this period is estimated at USD 59 billion, reflecting strong long term confidence in offshore production.

Engineering, Procurement, Construction and Installation (EPCI) spending is projected to peak in 2026, with overall expenditure continuing to rise as more complex deepwater projects move forward.

“This presents vast opportunities for Norwegian companies,” said Sørbø.

The GCE NODE FPSO Forum meet 2-3 times per year, bringing together various experts in a region that is well established within the FPSO sector.