The senior oil market analyst at Norwegian bank DNB gave a very bullish presentation during the second and final day of the Sørlandets Oil and Energy Conference Tuesday.

In his stack of slides was one entitled “Hello, 100 mb/d!!”.

“Our forecast shows a lightning quick increase in oil demand. We are very, very certain that oil demand will reach 100 million barrels per day within year-end. And also that the 2022 average will be at a pre-pandemic level, which is also 100 million barrels per day,” said Martinsen.

He listed several reasons for his optimism: Vaccine-driven demand rebound, normalization of mobility (people resume travelling), and strong emerging markets.

“The transportation sector alone accounts for 60 per cent of global oil demand. The sector took a severe hit a year ago and is still well below pre-pandemic levels in Europe. The situation is, however, very different in emerging markets. In China, for instance, both the number of domestic flights and the demand for oil are at higher levels than pre-pandemic. Emerging markets are characterized by strong growth,” said Martinsen.

The world experienced an unprecedented 8.5 per cent drop in oil demand following the outbreak of Covid-19. To contrast this number, Martinsen explained that demand dropped by only 1 per cent following the financial crisis.

(story continues below image)

OIL PRICE AT 65 DOLLAR PER BARREL

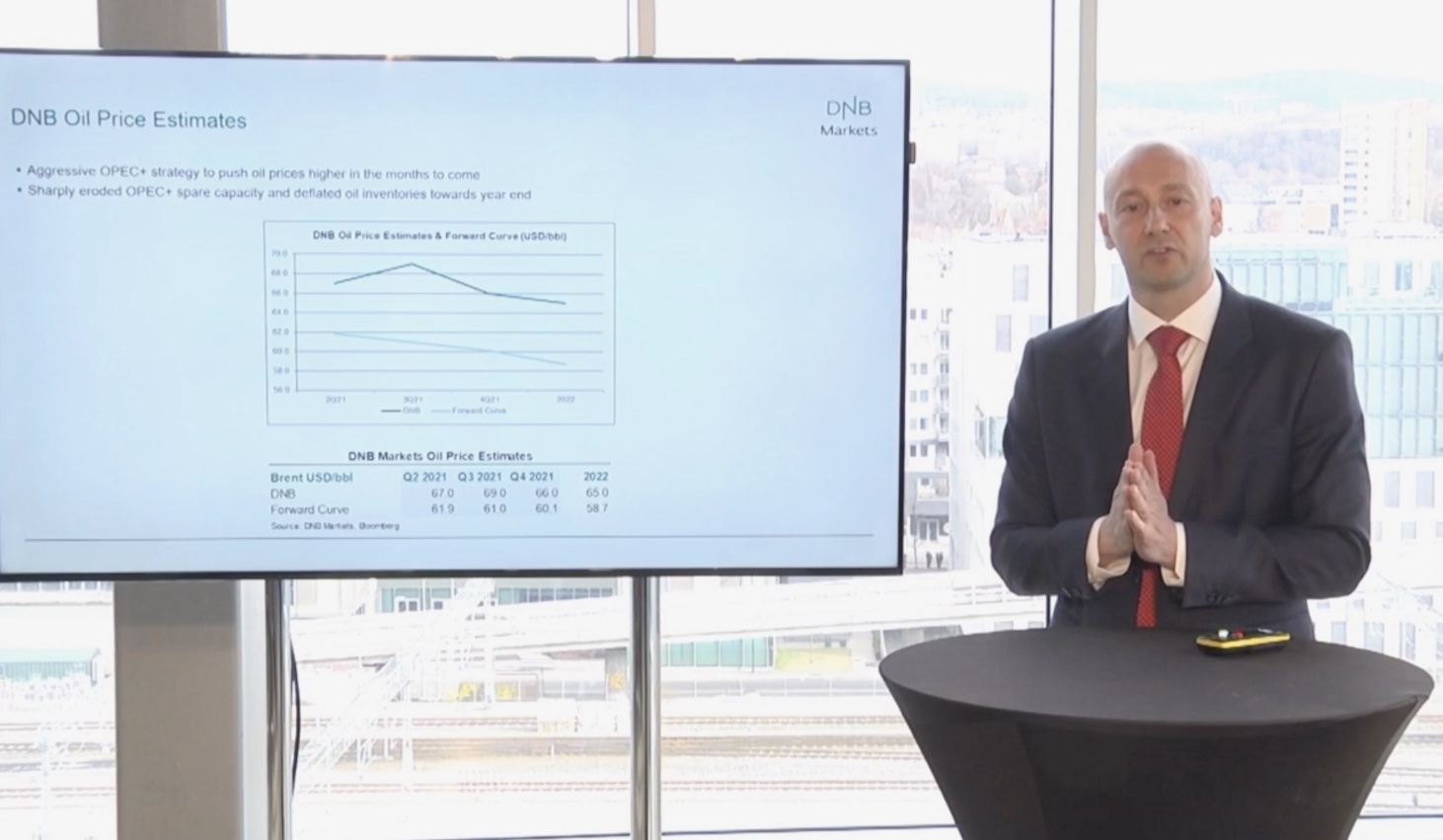

As for the price of oil, Martinsen and DNB expect the current price range of 60 to 70 dollars per barrel to be the norm for the next year.

“Despite a large spare production capacity, we are currently experiencing a tight physical market. This is a new and unexpected combination. OPEC shows great discipline and has surprised the market with deep production cuts and a high degree of loyalty to decisions made,” said Martinsen.

A 2022 price forecast of 65 dollars per barrel is based on continued strong OPEC discipline, an declining spare production capacity, and further depletion of oil storages.

“Oil producers enter times with significant cash flow. This could result in increased investments, but we believe the oil companies’ priorities will be as follow: 1) Pay debt, 2) Pay dividend, 3) Invest in renewables and 4) Invest in oil and gas,” said Martinsen.

These priorities seemed to be in line with the thinking and understanding of Eirik Bergsvik, CEO of MHWirth, and Frode Jensen, Senior Vice President Sales and Product Line at NOV Rig Technologies. Both gave presentations during the conference, and although more optimistic than before, agreed that the prospect of a new wave of new builds, seemed distant.

“We expect a higher level of activity within service and maintenance. It will probably take some time, but within the next years we will probably see some contracts for new builds,” said Bergsvik.

“OIL MARKET LOOKS PRETTY GOOD”

CEO of GCE NODE, Tom Fidjeland, summarized the conference and said the “the oil market looks pretty good”.

“How this will affect the supplier industry in Kristiansand and Agder, has yet to be determined. Both NOV and MHWirth expect a higher activity level within service, modifications and re-activation of rigs. There is also a strong focus on reducing emissions from oil production, and on renewable industries in the ocean space,” said Fidjeland.